Chopping off the tail: similar products, different constraints?

Share

In merger analysis, should competition authorities include a “long tail” of small competitors – or should they “chop it off”?

Usually, the answer is not in the size of competitors – but in how other factors, such as product range and geographical coverage, affect customers’ preferences. In this article, Andy Parkinson and Martin Wickens[1] lay out four ways in which economics can bring rigour to the assessment.

View the PDF version of this article.

The views expressed in this article are the views of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees or its clients.

Introduction

In any merger, competition authorities seek to identify which competitors constrain the merging parties, and how closely they compete. Those constraints matter for market definition and for the competitive assessment.[2] Sometimes, answering the question is straightforward. But not always: a “long tail” of small firms producing similar products can complicate the assessment of competitive constraints. On the one hand, one might be tempted to include the tail, on the basis that they sell a similar product. On the other hand, one might seek to “chop off the tail”, on the basis that they are “too small” to apply a substantial constraint on the larger merging parties. The choice can substantially affect market shares (see Figure 1) and, therefore, distort the lens through which authorities analyse the merger: is there a wide set of relevant competitors, or a narrow one? Neither shortcut – maintaining the tail, or chopping it off – is consistently reliable, and either can be misleading. By itself, the size of a competitor is arbitrary, and not an indicator of competitive constraints.

In this article, we look at recent EU and UK cases in which, even though a tail of competitors produced very similar products to the merging parties, sometimes that tail applied an effective competitive constraint on merging parties. And sometimes it did not. What mattered was the impact that other factors, such as the wider product range or geographical coverage, had on customers’ preferences and their willingness to switch to rivals. We specify four ways in which economic analysis can bring rigour to identifying where those constraints apply, and where they do not, avoiding the errors that shortcuts such as “chopping off the tail” could otherwise introduce.

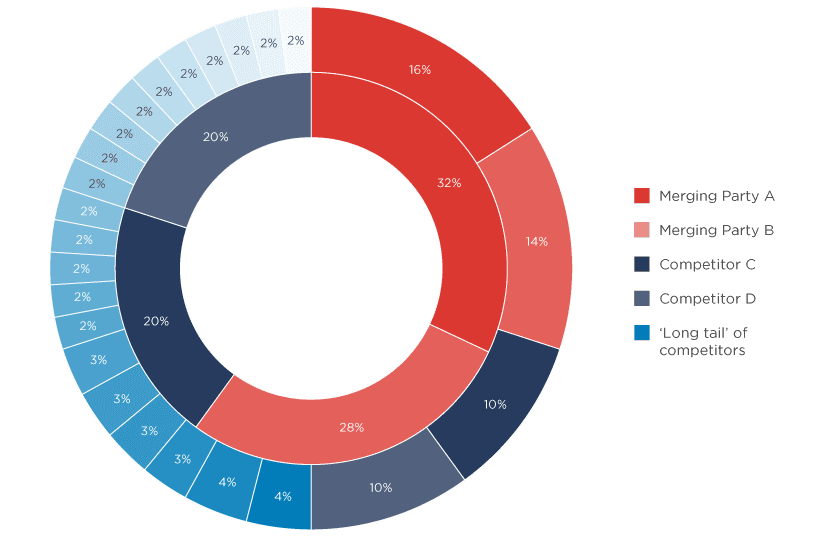

Figure 1: Market shares including and excluding a “long tail” of competitors

Note: Fictional market shares including (outer circle) and excluding (inner circle) a “long tail” of competitors. Chopping off the tail of competitors in this example increases the merging parties’ combined market shares from 30% to 60%.

When do similar products face different competitive constraints?

Even when firms sell similar products, they might not closely compete for customers. Suppliers of similar products can face different competitive constraints depending on additional dimensions of demand that customers need them to satisfy. Referring to examples that arose in merger assessments by the European Commission (“EC”) and the UK Competition Markets Authority (“CMA”), we discuss how competitors’ product range and geographical coverage determined how closely suppliers of similar products competed.

Dimension 1: Differences in competitors’ product range

Generalists versus specialists: do customers value ”one-stop shops” or ”mix-and-match”?

In some markets, customers require a range of related products. For some of those customers, “generalists” can provide a valuable one-stop shop, as they offer everything the customer needs from across the range of related products. This option might save the customer time or be easier to manage. In contrast, other customers may prefer to mix-and-match, choosing from different “specialist” suppliers, each of whom focuses on particular products in the range. This can allow customers to take advantage of a better service (for example, deeper knowledge), a wider range of alternatives within the set of products the specialists do offer, and to better tailor their purchases to their specific needs across the range.

In aggregate, specialists may supply a substantial proportion of the product range, even if each specialist has a relatively small market share. This can give rise to a pattern of market shares and concentration where the one-stop shop retailers have significant market shares, but also face competition from specialist suppliers, each focussing on a narrow offering.

The key question is whether the specialists constrain the generalists. Would the one-stop customers, faced with increased prices, switch to specialist suppliers? The answer depends on various factors: what is the value that having a ‘one-stop shop’ brings, and what is the extent of any switching costs and barriers? How easily can the specialists expand their range to offer ‘one-stop shop’ economies?

There are no simple, generally applicable, rules: the conclusion depends on the facts of the case In some cases, the CMA and the EC found that narrower specialists did not substantially constrain generalist suppliers.

- Yorkshire Purchasing Organisation / Findel Education Limited [3] was a merger between two suppliers of educational resources for schools and nurseries in the UK. The CMA examined whether specialists supplying one or few product categories substantially constrained the merging parties, two generalists. It found that specialists fulfilled a different purpose than generalists and treated them as suppliers outside of the relevant market, not including them in the shares of supply.

- In various retail mergers, the EC categorized the sale of goods by generalist retail outlets such as hypermarkets, supermarkets and discount chains (the so-called ‘modern distribution channel’) in different product markets from other retailers fulfilling a specialist or convenience function – such as specialised outlets (butchers, bakers, etc.) and service stations. The latter typically offered a narrower product range.[4]

However, in other cases, the CMA and EC found that specialists did substantially constrain generalists, at least for certain categories of customers.[5]

- The CMA examined the consumer cyber safety solutions landscape in the NortonLifeLock / Avast merger. The merging parties and some competitors had a wide offering, which included bundles where “endpoint security products” (commonly referred to as ‘antivirus’) were sold together with privacy, identity, and performance products. Other suppliers only offered a limited range; for example, only an “antivirus”. The CMA also included these in its shares of supply calculations. It noted that these suppliers offer a range of alternative options and in aggregate exerted a competitive constraint on the parties.[6]

- In Staples / Office Depot, the EC assessed a merger between two generalist office supplies companies. The EC found that, for customers who purchased ink & toner or paper separately from stationery products, specialist suppliers were able to exert competitive pressure on the merging parties. They had specialised knowledge and could offer competitive prices.[7] However, the EC found that only generalists were able to compete on the broader market for “traditional office supplies” (i.e., stationery, ink & toner and cut sheet paper).

Complex customer requirements and integrated solutions

A related issue is whether only a subset of competitors can meet particularly high or complex customer requirements. For example, in Staples / Office Depot, the EC distinguished between small customers and medium/large customers, because the latter had additional requirements that related to the process of ordering, account management, and delivery.[8]

In certain cases, customers value the ability of a single supplier to coordinate different products and services in a single solution – often referred to as an “integrated solution”. This goes beyond one-stop shop economies: there can be real advantages and synergies from having one single supplier coordinate – in terms of the use of facilities and resources, for example – the different services that make up the solution.

The question is: to what extent do integrated providers face constraints by suppliers who only offer individual lines? Would customer of integrated solutions switch to individual procurement for each line – taking on board the additional work required to coordinate between each component? The advantages of a single supplier taking on board the coordination role may be large enough that, post-merger, the merging parties could impose a price increase and customers would not switch to individual procurement. On the other hand, suppliers only offering part of the full range may be able to sub-contract the remaining components and assemble an integrated offering for customers.

The question came up in Halliburton / Baker Hughes, where the EC examined oilfield services – services to drill and complete oil and gas wells. Certain customers had started procuring “integrated services”: a single supplier was given responsibility for delivering several different services required to drill and complete a well – which traditionally were procured separately. The EC found that this solution – integrated services – could save on time and costs, in particular by better coordinating the different stages of preparing the well. It also found that the barriers to expand across different product lines were high – making it more difficult for specialist suppliers to start providing integrated services.[9]

Dimension 2: Differences in competitors’ geographical coverage

Customers can also have different requirements for geographical coverage. This can often arise where customers have multiple local sites. In some cases, the location of the supplier may not matter. In other cases, some local presence from the supplier is required to serve each site.

The question is then whether customers can rely on various local suppliers, each focussing on a smaller area, as a substitute for suppliers with coverage of a broad range of locations.[10]

- The CMA looked at providers of washroom services (i.e., supplying, servicing, and disposing of washroom waste) in Rentokil / Cannon.[11] It found that customers with national or multi-regional requirements needed a single supplier across the entire country, or at least across multiple regions. The merging parties were two of the three largest firms able to offer nationwide services and the CMA found competition concerns for these customers. In contrast, the CMA found no concerns in the supply to customers with local or regional requirements, which could be met by a much larger set of competitors with smaller local geographic coverage.

- Similarly, in Staples / Office Depot, [12] the EC identified a market for international contracts for office stationery – i.e., customers with requirements across multiple countries in Europe – which could only be served by suppliers with pan-European presence.

These two dimensions – geography and product range – often arise together in a case. For example:

- In Aon / WTW, [13] the EC considered that the merging parties were two of the “big three” firms able to offer commercial risk brokerage services to large multinational customers based in Europe. Only a limited number of brokers, in the EC’s view, had the necessary capability to handle large and complex risks of such customers and a suitable network to provide services internationally.

- In Mitie / Interserve, the CMA examined facilities management, that is, services to buildings and properties (cleaning, security, maintenance, etc.). There was mixed evidence on whether following a price increase customers could switch from national contracts to local contracts. The CMA assessed competition for contracts with national coverage separately from contracts with regional or local coverage. It also looked at the capabilities of specialists and generalists to compete for different types of contracts. While specialists were able to compete for contracts covering only one or few service lines, the CMA found that specialists would find it challenging to compete for customers procuring all services under a single contract, which the CMA termed “Integrated Facilities Management”.[14]

Key issues in the assessment

Each case turns on its facts. In cases involving customer preferences over a range of products or locations, competition can play out in complex ways. The assessment can be subtle, but maintaining rigour in the analysis is important, as it can have important implications to the outcome of a case. We offer four recommendations.

Lesson 1: Looking at the evidence and the facts of each case

First, and it should go without saying, we should look at the evidence in each case to see whether specialists constrain generalists (or local players constrain ones with broad geographic coverage). Asserting that “big is different” – and thus smaller competitors should be discarded – is insufficient: it is not an explanation of why large competitors might be closer competitors to each other than small competitors.

We need to understand customers’ ability and willingness (or lack thereof) to switch across providers of different types or of different coverage, and in turn, what determines that ability and willingness. This requires looking at the evidence: evidence on customer preferences and past or hypothetical substitution; evidence on product characteristics and intended use; evidence on prices and barriers and costs to switching; and so on.[15] On the supply side, we can assess whether the smaller competitors are potential entrants – who could easily start supplying across the product lines covered by larger competitors. These the types of evidence are often discussed for market definition but, too often, the assessment takes shortcuts – and, particularly where customers’ preferences and behaviour are complex, shortcuts risk giving a very partial picture of how competition works in the market.

Standard techniques in competition analysis can bring rigour and evidence to these questions. Surveys are often used to evaluate customers’ requirements along multiple dimensions – which can include product range and geographical coverage – and whether, for example, following a price increase they would switch from one-stop shop supply from generalists to mixing and matching across specialists.[16]

Analysing the merging parties’ sales data can also reveal customers’ behaviour and purchasing patterns: for example, do customers of a generalist usually purchase across different categories, or only from single categories? Where customers tend to purchase from single categories in a single transaction, specialists are likely a good alternative. Identifying customers that appear in both of the merging parties’ sales data using fuzzy matching techniques [17] can reveal important insights about their purchasing behaviour. If customers mix-and-match across the merging parties – buying one category of products from party A and another category from party B – it can indicate that mixing-and-matching across specialist competitors could be an equally good alternative.

Economics and data analysis can also indicate whether competitors can offer a product that would meet customers’ requirements. Increasingly sophisticated geographical evidence – for example, catchment areas based on driving times – is often used to evaluate competition at local level.[18] This type of evidence can help establish which firms are able to meet customers’ requirements across multiple locations, and which firms have more limited (local or regional) coverage. It requires linking business data – such as data on the locations of depots or stores of firms, or locations of key customers – to geographical or driving time data using data science techniques.[19]

Lesson 2: Price discrimination and market definition

Second, where a significant proportion of customers would switch between generalists and specialists, the ability to price discriminate between different groups is required for there to be different markets. If a company can respond differently to a tender which requires national supply than to a tender which only requires local supply – and tell these apart – price discrimination may be possible, and a merger may differentially affect customers with national requirements. Discrimination may also be possible in other contexts: in YPO / Findel, for example, the CMA found that generalist suppliers typically had good information about their customers and their purchasing patterns, which they can use to target terms of service including discounts at individual customers. Customers who are more likely to switch to specialists could be identified and offered targeted discounts, whereas customers that are unlikely to switch to specialists would face increased prices.[20]

However, where price discrimination is not possible, specialists might constrain generalists: generalists could fear that their customers might be willing to switch to specialists. They could have partial information: generalists might not be able to tell which customers would switch to specialists if they were not happy with their offers. Specialist suppliers could form a strong constraint even if only a minority of customers would switch between generalists and specialists. This is because, if the generalist supplier charges the same price to all customers, the question is whether a sufficient number of customers would be willing to switch to a specialist to constrain the behaviour of the generalist – not whether the average customer is willing to switch, nor whether there are captive customers who are unable to switch.[21]

Lesson 3: Avoiding the “in or out” fallacy

Third, the assessment should be nuanced – it is not always a matter of “in” or “out”; it can be a matter of degree. In some situations, instead of discarding competitors with a smaller range or coverage, the assessment can be framed in terms of different competitor “tiers” – with competitors in the same tier competing more closely, and competitors in different tiers exercising a lower constraint.

In other situations, it is appropriate to adopt a narrower framework, such as focussing on competition for customers “with national requirements”. This will affect how the analysis is structured and how evidence on competitive interaction should be interpreted.

In the case of market shares: calculating market shares for customers “with national requirements” is not as simple as excluding local firms and retaining firms with national coverage. We should include sales to customers requiring national coverage and exclude sales to customers with local requirements only, even if made by a firm which can serve national requirements. Firms with national coverage may focus on serving national requirements to a greater or lesser extent. Some national firms could even focus on local customers, making them a rather distant competitor for customers with national requirements, and local customers may account for a significant share of their sales. Including all of the firm’s sales in the market share calculations will overstate their presence in serving customers with national requirements. For example, last year we worked on the Culligan/Waterlogic deal in which the CMA found that, based on data submitted by the parties whilst both companies supplied bottled water coolers across the UK, Culligan did not play a material role in serving customers with large geographic footprints.[22]

Similar considerations apply to other types of analysis – diversion ratios, for instance. Where the focus is on competition for customers with national requirements, diversion ratios should be computed across those customers only to avoid providing a biased picture.

Lesson 4: The dynamic view

Fourth, the dynamic view of competition can differ from the static one. Smaller firms, or firms with a smaller range, could exercise a dynamic constraint by driving innovation by larger firms and act as potential disruptors. There is no reason to expect that, in general, innovation and disruption will always come from the largest firms in an industry. Indeed, these considerations have been at the core of recent prohibitions of acquisitions of small competitors from large firms.[23] A similarly close examination of the disruptive potential of smaller competitors is in order whether the smaller competitor is the target of an acquisition or a competitor.

Conclusion

In this article, we have explored situations where a long tail of small firms may, or may not, constrain larger merging parties that sell the same product. It depends not on their relative size, but whether other dimensions – such as product range and geographical coverage – determine how closely they compete for customers.

Previous cases do not provide easy rules of thumb that one can reliably apply in every case, or even in most cases. Shortcuts such as “chopping off the tail” of competitors are easy, but they can also be misleading: the assessment should be based on the facts of each case. Economics and data analysis are key in evaluating the evidence. Cases where competition plays out in complex and nuanced ways require rigour and careful scrutiny to assess the strength of the competitive constraint exercised by each competitor.

Read all articles from this edition of the Analysis

View the PDF version of this article.

[1] Andy Parkinson is a Senior Vice President at Compass Lexecon. Martin Wickens is an Economist at Compass Lexecon. The views expressed in this article are the views of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees or its clients. The article is partly informed by work the authors carried out in merger cases, including in various of the cases cited in this article.

[2] Different authorities place different emphasis on market definition, but the underlying economic issues remain the same – whether they are dealt with at the market definition stage, or in the competitive assessment. For example, the CMA’s 2021 Merger Assessment Guidelines have de-emphasized the role of market definition in merger cases. CMA (2021), Merger Assessment Guidelines, para. 9.2.

[3] See CMA (2020), Yorkshire Purchasing Organisation / Findel Education Limited, esp. para 9.73. The merger was abandoned after the CMA published its provisional findings and before the CMA published its final report.

[4] See for example the following EC decisions: Case No. M.2604, ICA Ahold / Dansk Supermarked (2001), para. 9-11; Case No. M.3905, TESCO / Carrefour (Czech Republic and Slovakia) (2005), para. 9-17 (esp. para. 10); Case No. M.4686, Louis Delhaize / Magyar Hipermarket Kft (2007), para. 6-10; Case No. M.4590, Rewe / Delvita (2007), para. 9-14; Case No. M.5047, Rewe / Adeg (2008), para. 12-24 (esp. para. 13 and 19); Case No. M.5112, Rewe / Plus Discount (2008), para. 15-17; Case No. M.7224, Koninklijke Ahold / Spar CZ (2014), para. 9; Case No. M.7933, Carrefour / Billa Romania and Billa Invest Construct (2016), para. 14-15.

[5] Similar considerations were taken into account by the CMA in Huws Gray Ltd / Grafton (2022). See para. 34-36.

[6] CMA (2022), NortonLifeLock / Avast. See for example para. 7.9 and 7.132.

[7] EC (2016), Case No. M.7555, Staples / Office Depot. See for example para. 218.

[8] EC (2016), Case No. M.7555, Staples / Office Depot, para. 159-169.

[9] EC (2016), Mergers: Commission opens in-depth investigation into acquisition of oilfield service provider Baker Hughes by Halliburton.

[10] Similar considerations have applied in other CMA cases including water coolers (Culligan / Waterlogic, 2022) and facilities management (Mitie / Interserve, 2020).

[11] CMA (2019), Rentokil Initial / Cannon Hygiene.

[12] EC (2016), Case No. M.7555, Staples / Office Depot.

[13] EC (2021), Case No. M.9829, Aon / WTW.

[14] CMA (2020), Mitie / Interserve. See for example para. 44-45, 57-68, 130.

[15] EC (2022), Draft Commission Notice on the definition of the relevant market for the purposes of Union competition law, section 3.2.

[16] Compass Lexecon has designed survey questions and analysed results in prior cases to assess these issues.

[17] Historically, matching data between parties was time-consuming and costly, because the same customer might be recorded with slightly different details in each Party’s sales data. Fuzzy matching techniques enable significant automation of this process. See Bharadwaj, B., Victoria, A. V., Owczarz, W., & Schuppli, W. (2022), Game, Set and Fuzzy Match, Compass Lexecon.

[18] Compass Lexecon teams have provided this type of evidence in several cases, including the aforementioned Huws Gray Ltd / Grafton merger (CMA, 2021).

[19] Kocanova, I., Foster, J., & Howard, T. (2023), A taste of geospatial analysis for competition economics, Compass Lexecon.

[20] CMA (2020), Yorkshire Purchasing Organisation / Findel Education Limited. See para. 9.62 in particular.

[21] Focussing on the behaviour of large categories of customers, rather than marginal customers, is the so-called “toothless fallacy” in market definition. The name of the fallacy originates from the United Brands case, where the EC argued (and the ECJ found) that bananas were a distinct market compared to other fruits because of their “softness” and other characteristics which made them suitable for the very young, the old and the sick. See Case C-27/76 United Brands v Commission, EU:C:1978:22, p. 273.

[22] See CMA (2022), Culligan / Waterlogic, para. 172.

[23] See e.g., the CMA’s prohibition of Facebook / Giphy in 2022 and the discussion in Walker, M. (2023), The UK Facebook/Giphy Case: Taking Dynamic Competition Seriously, Network Law Review.