What the ex-ante benchmark reveals about the reasonable price for SEP licences

Share

Can licences for value-adding technology be worth nothing?

In this article, Pekka Sääskilahti [1] and Andrew Tuffin revisits the influential ex-ante benchmark for valuing Standard Essential Patents (SEPs), and discusses what it tells us about the relationship between the value standard essential technology provides and the prices to license that technology that we should consider FRAND (Fair, Reasonable, and Non-Discriminatory).

View the PDF version of this article.

The views expressed in this article are the views of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees or its clients.

Introduction

SEP licensing disputes are common, intense, and difficult to resolve. At root, they are about the relationship between value and price. The problem is that, although standard essential technology provides value, companies negotiate licence prices ex post – after the technology is already essential to a successful industry standard and alternatives to reaching an agreement are eliminated. At that point, there is a risk that prices reflect a party’s desperation for an agreement on any terms, rather than one based on the value contributed by the licensed technology. That risk should be averted by the FRAND commitment – in which, licensors promise to make their SEPs available on Fair, Reasonable, and Non-Discriminatory terms. But the assurance FRAND provides is vague. The benchmarks often used to determine whether disputed licence terms are FRAND are beset with problems.

In this article, I examine the ex-ante benchmark, which seeks to determine a reasonable price by reference to the competitive price that a technology would have commanded before it became essential to the standard that licensees adopt. The result it provides appears paradoxical: when ex-ante competition is intense – as we should hope it would be – the competitive price that the winning technology receives can be zero, or otherwise so low that its licensor would have been better off had it never invested in developing the technology at all. Even when that technology offers value to others. Consequently, the ex-ante benchmark (a) relies on strong incentives to compete for inclusion in the standard, so that innovators develop value-adding technology and license it at competitive prices; and simultaneously (b) undermines that incentive.

Although the ex-ante benchmark appears to be ex-post appropriation by design, we shouldn’t dismiss it out of hand. Conceptually, it is simple enough to correct so that it provides incentives for both innovators of standard technology, and implementers of it, to participate in standardisation. And having done so, the dynamics it reveals about value and competitive prices can guide us through many other controversies that plague SEP disputes, particularly those that the advent of the Internet of Things (IOT) threatens to exacerbate.

What makes technical standards valuable?

Technical standards create value. They do so from two sources: (a) the fact they are standards – allowing the market to enjoy the benefits of co-ordinating around a single convention – and (b) the fact they are technologies – providing a new or enhanced functionality that consumers are willing to pay for.

The benefits of standards

Many industries agree “simple” standards – such as those defining the dimensions for paper, bricks, screws, credit cards, shipping containers, electrical plugs, and many other goods – so that arms-length companies can co-ordinate, producing identical or compatible products. Setting a standard approach is particularly important in digital sectors where products need to exchange data. These standards specify much more complicated and technical approaches than “simple” dimensions do, but the benefit of co-ordinating around them provides benefits in a similar way. For example, telecommunications standards ensure that your phone will have a signal wherever you are in the world, because all market participants agreed to use the same cellular technologies as standard. It doesn’t matter who made the phone, or the network infrastructure, or which government licensed the radio spectrum that carries data between them.

The economic benefits of co-ordination and compatibility are enormous, for both companies and consumers. They lower costs (through economies of scale), reduce prices (by preventing “lock-in” to a specific supplier or subset of suppliers), increase product quality and choice (by intensifying competition between companies implementing the standard), and create more opportunities for compatible and complementary goods and services.[2] Although competition law is strict about co-ordination between competitors, it has not been a major obstacle for standards as they provide so much value and they are possible to set while maintaining adequate level of competition.

The benefits of technology itself

The technology specified in technical standards is valuable in its own right: it provides functionality that benefits consumers, increasing demand for the products that implement it. For instance, the technology specified in the 4G cellular communication standard, LTE-A, enables phone users to stream data at peak speeds of 1 gigabit (1000 megabits) per second. That functionality is strictly better – and more valuable to consumers – than the functionality earlier technologies provided. The first 3G standard, UMTS, had a theoretical maximum speed of 2 megabits per second, 500 times slower than the technology specified by LTE-A.[3] The benefit of improving that functionality was not just that it enabled people to stream videos, it opened possibilities for numerous internet-based services, created new industries, and put the broadband speed internet in consumers’ pockets across the globe.

The value that technology contributes to a market is distinct from the value of co-ordinating around it. If the best global cellular standard still specified technology that limited us to theoretical peaks of 2 mbps, then markets would still have the benefits of co-ordinating around a global standard, but our phones would be less useful and consequently less valuable to us. Implementers would also lose out, as consumers would pay less for their products and/or buy fewer of them. We can analyse the extent to which technology adds value for consumers and implementers using the Present-Value Added approach: a valuation methodology endorsed by the EC for informing SEP disputes.[4]

The importance of ex-ante competition to create more value

The way companies compete determines how much value they produce for consumers.

When standards compete in the market for consumers, they compete on both fronts: the benefits of the functionality they enable, and the benefits of the community that co-ordinates around them. That makes successful standards very hard to replace, even if rivals offer superior functionality. The value of the large community that could co-ordinate around any technology, but happens to co-ordinate around an incumbent one, protects that technology from rivals offering superior technologies with smaller communities co-ordinating around them. That barrier doesn’t really matter when the difference between rival approaches is relatively arbitrary; for instance, it’s not a problem that the dimensions of shipping containers and paper haven’t substantially changed for generations. But it does matter for standardised technologies. We want superior technologies to emerge and replace inferior ones.

To overcome this barrier, Standard Development Organisations co-ordinate ex-ante competition: where rival technologies vie to become the next standard before it goes to market. This process should promote both sources of value. First, it consolidates demand from implementers around a single technology, protecting and expanding the value of co-ordination, and avoiding the risk of fragmentated markets, or the need for them. Secondly, it makes competition for that market contestable, increasing the quality and value of the technologies that become the standard.

What makes negotiating licences so challenging?

The value standardised technology provides should benefit everyone: licensors, licensees, and consumers.[5] However, SEP licence negotiations occur ex post – after the technology has been developed, adopted into standards, implemented in products, and its value has been created. This makes negotiations about a price closer to a zero-sum game, introducing the risk that an agreement leaves a party worse off than if it had never participated in the market in the first place, even when it contributed considerable value. The problem is that a widely adopted standard doesn’t just provide benefits; it also eliminates the alternatives to it, distorting parties’ relative bargaining power in licence negotiations.

The relative bargaining power of ex-post negotiations

Normally, a licensee can walk away from a licence negotiation in favour of alternatives that offer better value for money. The implementer of a successful standard can’t do that. Even if rival technologies competed ex ante, they are unlikely to be viable alternatives ex post. Ex-ante competition ensures that the standard adopts technologies that provide the best functionality and consolidates demand from implementers around that approach. As such, rivals will struggle to compete against that combination, making licensees’ switching costs very high, if they can switch at all.

Similarly, an SEP licensor can’t walk away from a licence negotiation in favour of alternatives that offer better value. Normally, it could play rival licensees against each other in a bidding war, or could implement its own technology exclusively, asserting its property rights to prevent free-riders from copying its products. But a licensor of SEPs can’t do either. In return for the opportunity to compete for inclusion in a large consolidated standard, licensors had to commit to license on FRAND terms. As such, exclusive implementation and bidding wars are ruled out within the standard. Neither can it opt out of the standard to license its technology exclusively or on more favourable terms.

Courts constrain relative bargaining power and can determine which side has it

In SEP negotiations, parties’ only alternative options to an agreement are through litigation. As such, which side has the upper hand or how much relative power they have is not an inherent feature of SEP disputes, it depends on what conduct courts (and competition authorities) permit and prevent.[6]

When licensors have sufficient leverage to exploit licensees’ irreversible commitment to the standard, it is referred to as “the hold-up problem”. For instance, if a licensor can credibly threaten a licensee with exclusion from the market, that licensee will be willing to pay what it takes to stay in business, not whatever reflects the value the licensed technology provides.[7] In practice, current law and policy softens that threat: injunctions for SEP holders are hard to come by on either side of the Atlantic; they are only available to licensors that courts deem to be acting in good faith, against implementers that courts deem to be acting in bad faith; and, in any event, injunctions are used to enforce rates that an independent party (i.e. the court) has validated as FRAND, not whatever the licensor happens to demand.[8]

When licensees have sufficient leverage to exploit licensors’ irreversible commitment to the standard, it is referred to as “the hold out problem”. Implementers can’t (legally) enjoy the benefits of implementing technology without an agreement indefinitely. But, if they can drag out negotiations for a licence, they could force a desperate licensor to accept terms that are far below what is reasonable. For instance, if licensors can only make a return if they chase reasonable payment for every patent in every jurisdiction, then they would give up when the costs of the chase were no longer worth the reward – or, never enter the competition to develop value-adding technology in the first place. Recognising this patent-by-patent and jurisdiction-by-jurisdiction approach to licensing as “madness” (in the context of global standard with tens of thousands of essential patents declared), courts have become increasingly open to awarding global portfolio rates for disputed licenses.[9]

The risk of hold up and hold out is not restricted to the disputes we observe. Companies don’t queue up to be exploited. The main threat to competition and consumers is that innovators and implementers that would have competed and contributed value are excluded, deterred by the prospect of ex-post appropriation. Implementers won’t develop standard compliant products if they fear licensors will exploit the lack of alternatives to expropriate their profits, and they lack the means to seek reasonable terms from a court. Similarly, innovators who depend on licences for a return on capital, won’t invest in developing technology if they fear licensees will not pay fair compensation and lack faith that courts can force them to do so.

Why are the proposed benchmarks for fair and reasonable prices problematic?

The FRAND commitment should exorcise the spectre of hold up and hold out.[10] If courts could guarantee FRAND settlements, then neither implementers nor innovators need fear exploitation once they have irreversibly committed to the process of standardisation. However, the benchmarks proposed to determine whether or not a price is FRAND offer no such guarantee. They are often unsatisfactory and vague.

The difficulty with benchmarking prices against “comparable” agreements

Courts prefer to determine the reasonable price for a portfolio of SEPs by referring to the terms agreed “comparable” contracts. The hope is that these contracts reveal “market prices”, that similarly situated companies were willing to accept as mutually beneficial and, therefore, offer a practical benchmark for prices we should consider “reasonable”. However, when applied to SEPs, this approach has challenges both in practice and in principle.

In practice, contracts that reflect the prices paid in ‘comparable’ situations are rarely available and unambiguous. Firstly, there may not be any comparable licences to inspect. When valuing real estate there are numerous transactions to review, with public information on the prices paid and the features each house has. That is not the case for licence agreements. They are infrequent, confidential, their features often affect the value of the contract in opaque ways, and they often include other licences or services that obscure how much was paid for the comparable licences. The payment structure can also vary widely, including payments in kind. While attempts can be made to ‘unpack’ these complexities, results vary and are prone to cherry-picking.[11] It is not uncommon for courts to seek comparable contracts, but not find any that are sufficiently reliable.[12] Overall, courts have not adopted a common framework for the analysis of comparable contracts resulting in much variation in their decisions.[13]

In principle, comparable contracts face another problem: they don’t necessarily indicate prices that are fair and reasonable. If one is genuinely concerned that ex-post negotiations reflect excessive bargaining power rather than the value of technology, then using rates from contracts that companies agreed to in the shadow of that excessive power can only perpetuate the problem, not resolve it. It is even more problematic if hold up or hold out has already excluded firms from the market (whether implementers without the resources to defend themselves in court, or innovators dependent on licence fees who lack the faith and resources to pursue their rights). Comparable contracts only reveal the rates agreed by the companies we have, not the reasonable rates that excluded companies would have agreed to.[14]

The difficulty with an ex-ante benchmark for technology’s value

Alternatively, the “ex-ante” benchmark has been offered as a principled way to identify the price of technology itself, before standardisation distorted the bargaining process.

The intuition is that a reasonable price for a licence is given by the competitive price that a licensee would have paid immediately before the technology’s inclusion in the standard.[15] At that point, if a licensor sought an excessive royalty for inclusion in the standard, prospective licensees could have turned to a competitor who offered better value for money. If no rival existed, they could have chosen not to update the standard at all. Swanson and Baumol first specified the approach formally.[16] It can be characterised as either a series of bilateral negotiations, or an auction between technologies bidding for inclusion into the standard that licensees will adopt, taking place just before the standard is specifies the successful technologies.

The central insight is that licensees would pay only the incremental value that the best technology offers them compared with the value offered by the next best alternative technology, plus the price the next best alternative is available for. As there are no prizes for second place in an ex-ante competition to be included in the standard, and the losers have no viable prospect outside the standard, the next best alternative would settle for nothing.

Courts have looked on the principle behind the ex-ante benchmark favourably, but acknowledged that it is not a practical methodology. Standards contain many technologies and they are frequently updated – cellular standards have had 18 major releases between 1998 and 2022, containing many patented technologies. That makes conducting ex-ante negotiations, or simulating them with hindsight, very difficult to do if not impossible. As such, the benchmark has had little direct impact on litigation.

However, the ex-ante benchmark has had an indirect influence on the rates that parties expect and demand. It predicts that the competitive prices for SEP licences should be very low, or even zero, on the basis that the ex-ante competition that SDOs co-ordinated was strong: (a) rival technologies that competed for inclusion in the 3G and 4G standards existed and (b) they offered similar functionality. Had there been an ex-ante negotiation before those standards were defined, licensors would have entered an ex-ante bidding war and haggled the competitive price down to nothing – writing off their sunk development costs.

The ex-ante benchmark has been criticised. Although it articulates a competitive price for the given situation, it has been argued that it cannot indicate what is FRAND in the context of standards; as it provides no incentive for innovators to develop technology and contribute it to standards in the first place. The implication is that the fact that rival technologies competed ex ante relies on those innovators not expecting to be rewarded using an ex-ante benchmark. Had they known that would be the approach, they would not have made the investments necessary to compete in the first place.

How do we correct the ex-ante benchmark?

We shouldn’t dismiss the ex-ante benchmark entirely. The flaw is in its timing: it is ex-ante for licensees, but not for licensors. They still lack outside options and face ex-post appropriation. Essentially, the problem isn’t that the benchmark is ex ante; it is that isn’t ex ante enough.

To see this, contrast the outcomes of two otherwise identical ex-ante negotiations: the first is held before standardisation, but after the technology is developed; the second is held before either side is irreversibly committed.

The situation

For illustration, consider ex-ante negotiations to license technologies that are competing ex ante to be included in a new standard, 7G.

- a. The economic value expected from the functionality: Phone manufacturers require a standardised technology that enables users to download data at 100gbps. They estimate that functionality will add $200bn in benefits to mobile phone consumers (the benefits of faster rates, which manifests in greater benefits per customer, and more customers).

- b. The costs expected to develop the technology: Before incurring any costs, innovators expect it will cost $20bn to develop a technology that could provide the functionality desired. This forms an “ex-ante minimum incentive price”: the price below which the licensor expects to lose money, even if it wins the competition to be adopted into the standard. For simplicity, assume that price only depends on the innovators’ expected R&D cost.[17]

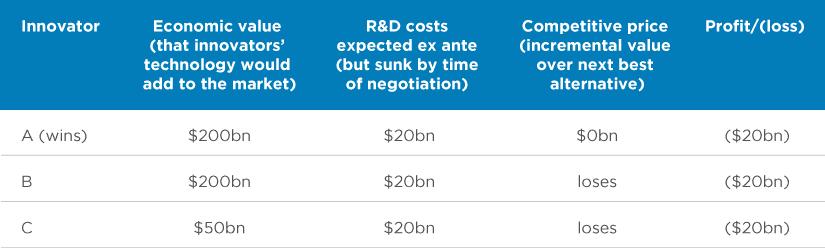

The “standard” ex-ante benchmark: intense competition before standardisation, but after R&D costs

In the first scenario, consider what happens when three innovators have competed to be included in the standard, and negotiate licences before the winner is adopted into the standard, but after each has incurred the costs of developing the technology. As Table 1 summarises:

- a. Two innovators (A and B) develop technology that meets implementers’ standard requirements, and either one would add the same economic value to the phone industry: $200bn to be shared between consumers, implementers, and innovators, after deducting any additional implementation costs. Innovator C’s technology offers weaker functionality that would only add $50bn to the market.

- b. Fighting to be included in the standard, innovators A and B start a competitive price war. Ex-ante competition ensures they will get nothing outside the standard. But as each technology is as good as the other and their development costs are sunk in any case, the price the winner will bid for inclusion in the standard is also nothing.

- c. Having spent $20bn to invent their technologies, each innovator makes losses – even the winning technology that adds value to the market.

Table 1: An ex-ante negotiation, before standardisation and after development.

As a benchmark for FRAND, this method of rewarding innovation is self-defeating. If the innovators had known how royalty rates would be set, none of them would have developed their technology in the first place – even though it adds value and licensees are willing to pay for it. While it is true that rival technologies competed ex ante for inclusion in the cellular standards we now benefit from, that does not suggest that the reasonable royalty for licensing the successful technology may be zero. It suggests that we may not have had that beneficial ex-ante competition if innovators thought that the winner would be rewarded using the ex-ante benchmark.

If an innovator knew that SEP licences would be valued in this way, it would only invest in competing ex ante for inclusion in a standard if:

- a. it believed the incremental value it provided would exceed its expected costs, either because (i) other innovators would fail to develop technology that offered any value; or (ii) the value its technology offered would far exceed that offered by any competitor; or

- b. it didn’t rely on licence fees to reward its investments, either because (i) it is a vertically integrated company that sells products implementing its own technology, or (ii) its innovation is incidental, a spill over from some other commercial activity.

At worst, applying these rules would collapse participation in standardisation, eroding the benefits of co-ordination.[18] For instance, if all innovators abandoned the standard and offered their technology privately, then the market would fragment (reducing the benefits of co-ordination), and the available technology would be weaker (as the standard could not stimulate and combine the best technologies through ex-ante competition).

At best, the standard would continue, but it would have anaemic ex-ante competition to develop new technology. Companies that do not rely on licence fees to develop their technology would still participate, but there are necessarily few companies with the scale and skills to lead in both innovation and implementation.

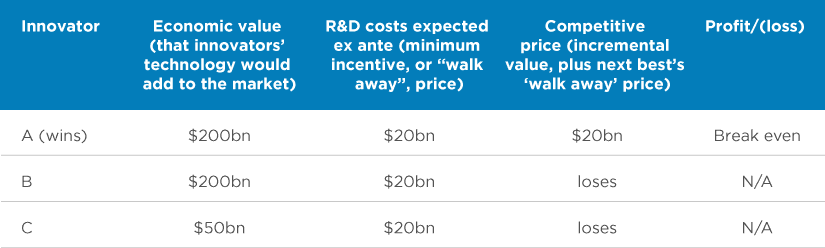

The “double” ex-ante benchmark: intense competition before standardisation and before incurring R&D costs

It is simple to adjust the ex-ante benchmark so that it provides strong and sustainable incentives to compete ex ante. Hypothetically, if licensors and licensees negotiated before innovators had committed and sunk their investments, then ex-ante competition would have the desired effect.[19]

Table 2 shows the same negotiation as above, except the timing is earlier: before innovators sink their development costs. This time, if the price offered is less than the money an innovator expects to incur developing the technology, it can and will walk away.

- a. Again, all the technologies offer functionality that will add $200bn to the market if adopted into the standard.

- b. Again, they will earn nothing if they lose the competition to be accepted into the standard, which ignites a price war. Again, each technology offers no incremental value over its next best rival, meaning prices race to the bottom. However, this time, that bottom is sustainable.

- c. The licensors compete away profits, such that consumers and implementers take all of the $180bn surplus the technology is expected to generate. But they don’t compete away their incentive to develop the technology that provides that surplus.

Table 2: A “double” ex-ante negotiation, before standardisation and before development.

This “double ex-ante” benchmark demonstrates the incentives we would hope to see.

First, no technology will be developed that costs more than the value it offers. Consider the scenario above, but this time the innovators expect to incur $300bn to develop their technologies. Regardless, licensees will not pay more than the value the technology adds: $200bn. Innovators won’t incur losses to provide those benefits. They will consider cheaper ways to deliver those benefits, or ways to offer more benefits.

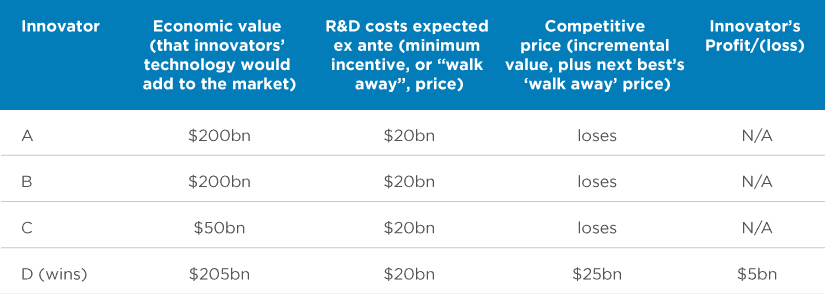

Second, innovators will focus their efforts where they offer the most incremental value. Consider the scenario above, but this time, two other innovators D and E are considering their options. Innovator D can offer slightly better functionality, worth $205bn, and expects to incur the same costs as the others. The competitive price it can command is £25bn: the incremental value it offers over the next best alternative ($5bn = £205bn – $200bn), plus the minimum price that next best alternative commands ($20bn, its minimum incentive, or “walk away” price). Innovator D will compete, win, and improve the standard for consumers and implementers.

Table 3: A “double” ex-ante negotiation, before standardisation and before development.

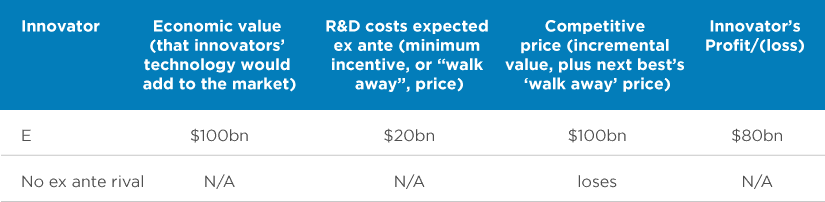

Innovator E can either develop the same technology as innovator D, or some other functionality that adds $100bn to the market that no other innovators can develop. But it can’t do both. Innovator E will develop the technology that adds $100bn to the market, not the technology that adds $205bn, because the incremental value that technology offers is much greater ($100bn, rather than $0bn) and licensees will pay more accordingly.

Table 4: A “double” ex-ante negotiation, for a second functionality the standard could provide

Is a double ex-ante benchmark justified?

It is tempting to think that the double ex-ante benchmark is unjustified, because licensing typically occurs after the costs of developing an innovation are sunk. That is a normal feature of a market economy.[20] While true, that fails to recognise how standardisation, FRAND, and ex-ante competition to be in the standard affect that normal situation for licensors. Normally, licensors will have outside options once it comes to licensing their invention. In an ex-ante competition for inclusion into a standard, they won’t.

As discussed above, in a normal negotiation, a licensor has two alternatives it can fall back on if it doesn’t like the price offered by a potential licensee for the technology it has already developed: it can implement the technology itself, exclusively; or it can use the competitive tension between licensees, choosing to license only the highest bidder, or bidders.

In an ex-ante negotiation for inclusion into a standard those options have been eliminated. If ex-ante competition pushes the competitive price below the innovator’s minimum incentive, or “walk away” price, it can no longer opt out. The normal alternatives aren’t available. It can’t viably compete against the standard, whether it attempts to implement the technology in its own products or license it to implementers outside the standard. The ex-ante competition eliminates demand for non-compliant products. Demand will consolidate around whoever is adopted into the standard, on whatever terms specified – particularly if that standard forces the winner to give its technology away for free. Innovators’ outside options only return if enough innovators withdraw from the ex-ante competition to cripple the standard and destroy the benefits of co-ordination and ex-ante competition to develop it. But that is unlikely, given that vertically integrated companies will compete for inclusion whatever the licence rates are likely to be. Instead, rates will be low, and competition to earn them anaemic.

Inside the standard, the incentive to innovate for a company remains if it expects to exceed its rivals by mile, or if expects to have no competition. Otherwise, it will require other funding sources to incentivise its research and development.

What does the ex-ante principle tell us about reasonable prices?

Of course, in practice, a “double ex-ante” benchmark would be even harder to calculate or implement than the original ex-ante benchmark. Nonetheless, it reveals dynamics about the value of standard essential technology that help us resolve, or mitigate, many of the issues that plague SEP disputes, particularly with the advent of IoTs.

Observation 1: FRAND is a range

The double ex-ante benchmark reveals that the competitive price that licensors would command falls in a range.

That range has a ceiling. Licensors cannot extract more than the economic value that implementing their technology adds to a market. In the scenarios above, licensees would rather walk away than pay more than the $200bn the technology contributes.

That range also has a floor. Licensees cannot pay less than the minimum price innovators would have accepted before incurring their development costs.

In principle, where the competitive price in a double ex-ante negotiation would fall in that range depends on the intensity of ex-ante competition. Although it might be impractical to define a FRAND price as that competitive price, the dynamic is informative. A pragmatic approach could determine a FRAND price should lie between the competitive ceiling and floor – both of which we can estimate – such that (a) neither side could face ex-post appropriation, and (b) agreements would balance innovators’ and implementers’ ex-ante incentives to compete and contribute to standards.

Observation 2: the value added by technology changes with product markets, not with licensing levels

Two debates have dogged SEP disputes since the smartphone patent wars. They are distinct but related.

- a. Whether a FRAND royalty rate should be reflect the potentially different values of the consumer devices that use that technology: for example, Apple argued in 2012 that ”it is akin to a toll on a highway: the toll is identical for a jalopy and a new sports car—the sports car does not pay more just because it is faster, more stylish, and has a better sound system”.[21]

- b. Whether the licensing level should alter the FRAND payments, as the royalty base differs: for example, even though a $600 phone costs 20 times more than a $30 chipset, should the royalty be the same regardless of which one of them bears the licence?

Both debates could be exacerbated by the advent of IoT.

On the first issue, IoT will introduce many more product markets, with a far greater range in prices. A 5% royalty on a $600 phone might provide a reasonable $30 payment. But the same rate on a $20,000 car or a $3 sensor may be entirely unreasonable.

On the second issue, IoT will introduce many more implementers, many of which lack the capacity and skills to negotiate licences. Even if they did, the expected transaction costs from negotiations and disputes could make end-user licensing unviable for licensees and licensors. As a result, different licensing models have emerged. Some license to device manufacturers using list prices, hoping that transparency will reduce transaction costs and disputes. Others license to component manufacturers, as relatively few companies supply the many device manufacturers with chipsets. Both models have their critics, but the key question is how they should affect royalty rates.

Firstly, an ex-ante benchmark (whether single or double ex-ante) tells us that the competitive – and reasonable – price range will vary between different products (and product markets). That is because the maximum amount that licensees would be willing to pay ex ante would depend on the additional benefits that functionality would provide to the consumers they sell products to, which varies between products.

For example, consider an ex-ante negotiation where the manufacturers of connected fridges seek licences for 7G. Even if an average fridge costs consumers the same as an average phone, the value the cellular technology’s functionality adds to the two products likely differs. The fridge doesn’t really need to be wirelessly connected; the phone does. The fridges don’t really need large download speeds; the phones do. That’s not to say the technology adds no value to connected fridges at all; it just adds less. Rather than the $200bn that the phone manufacturers were willing to pay up to, fridge manufacturers’ ceiling might be only $10bn, beyond which they and their consumers would be better off without the technology. Note that charging the same price in different markets would create a needless dilemma: it would either price out implementers where value could have been added but that value is low; or under incentivise innovators in situations where their technology adds most value.

Secondly, an ex-ante benchmark (whether single or double ex-ante) tells us that the economic value added to a product market does not vary by licensing level. Reconsider the competitive price that phone manufacturers would have agreed to in an ex-ante negotiation for technology that had no rival technologies. The price that they are willing to pay depends on the value the technology provides to their consumers; if the consumers are expected to be willing to pay up to $200bn for the additional benefits the functionality provides, then licensees can pass on licence costs up to that amount.

Now consider if the component suppliers of phone manufacturers negotiated ex-ante instead. The amount that component manufacturers are willing to pay depends on what their customers (i.e., phone manufacturers) are willing to pay when they pass on the licence cost. Ex-ante, that, in turn, depends on what those customers’ own customers (consumers of phones) are willing to pay for the functionality the technology provides. The value the functionality adds for consumers cascades down the supply chain; it is still $200bn. Imagine that that results in a $30 royalty on a component that would have cost $30 to buy without a licence. The royalty would impose a 100% markup on the licensed chip, but it makes no difference. The costs to consumers, and implementers, is the same. They buy the licence and the chipset for a combined $60 in both cases, a price they are willing to pay given the value it adds.

The importance of promoting ex-ante incentives to compete for the market

Ex-ante competition is beneficial: it increases the benefits of co-ordination and compatibility, intensifying competition between implementers of the standard; and it increases the benefits of technology, intensifying competition between innovators to develop better functionality that adds more value to the standard. And it avoids the standards wars that would otherwise force a compromise between the value of technology and the value of co-ordination.

However, ex-ante competition shouldn’t be used as a trap: appealing to intense competition to justify prices that remove the incentive for innovators to compete ex-ante. That is neither practical nor principled. Ultimately, it reduces the value that standardised technology will add to markets. And it reduces the proportion that consumers enjoy of whatever value the remaining technology provides.

While the ex-ante benchmark – however we define it – has little direct application to SEP disputes, its influence is important. It doesn’t reveal that value-adding technology should command little to no reward. Rather, it shows how reasonable prices should take into account innovators’ and implementers’ incentives to contribute to standards, before their alternative options are eliminated. And it demonstrates how reasonable prices might change depending on the market and license level involved.

Read all articles from this edition of the Analysis

View the PDF version of this article.

[1] Pekka Sääskilahti is a Senior Vice President at Compass Lexecon. The views expressed in this article are the views of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees or its clients. With thanks to the Compass Lexecon Research Team for its assistance.

[2] Jorge Padilla, John Davies, and Aleksandra Boutin, Economic Impact of Technology Standards, (September 2017). Available at: https://www.compasslexecon.com/economic-impact-of-technology-standards/.

[3] Specifications available at www.3gpp.org.

[4] On the Present Value Added approach, see page 110 in “Group of Experts on Licensing and Valuation of Standard Essential Patents ‘SEPs Expert Group’ - full contribution”, available at https://ec.europa.eu/docsroom/documents/45217. The approach was developed by economists at Compass Lexecon, and has been applied in litigation cases.

[5] See the Coase Theorum (“If one assumes rationality, no transaction costs, and no legal impediments to bargaining, all misallocation of resources would be fully cured in the market by bargains”) Coase, R. H. (1960). "The Problem of Social Cost." Journal of Law and Economics, 3: 1-44.

[6] Bargaining outcomes are also determined by the preferences of the negotiators and the situations of the firms, see e.g. Miettinen, Topi and Ropponen, Olli Tapani and Sääskilahti, Pekka, Prospect Theory, Fairness, and the Escalation of Conflict at Negotiation Impasse (June 2018). Available at SSRN: https://ssrn.com/abstract=3222620 or http://dx.doi.org/10.2139/ssrn.3222620.

[7] In particular, see M Lemley and C Shapiro “Patent holdup and royalty stacking”, Texas Law Review, Volume 85, pp. 1941-1996.

[8] The EC and European courts have adjusted their positions over time to better balance incentives for implementers and innovators of standards. In April 2014, the EC ruled that seeking (and enforcing) an injunction on the basis of SEPs constitutes an abuse of a dominant position prohibited by EU antitrust rules (see Motorola and Samsung). The European Court of Justice struck a balance between competition to implement standards and IPR holders’ rights, for instance, providing guidance on licensees’ responsibilities in a negotiation; see Case C-170/13, Huawei Technologies Co. Ltd v ZTE Corp., ZTE Deutschland GmbH, EU:C:2015:477. In Unwired Planet v Huawei, the court awarded an injunction only in the circumstance that Huawei did not agree to terms that the court had determined were FRAND. See [2020] UKSC 37 available at https://www.supremecourt.uk/cases/uksc-2018-0214.html.

[9] [2017] EWHC 711 (Pat), paragraph 543. Available at https://www.judiciary.uk/wp-content/uploads/2017/04/unwired-planet-v-huawei-20170405.pdf.

[10] The ETSI IPR policy states that “It is ETSI's objective to create STANDARDS and TECHNICAL SPECIFICATIONS that are based on solutions which best meet the technical objectives of the European telecommunications sector, as defined by the General Assembly… In achieving this objective, the ETSI IPR POLICY seeks a balance between the needs of standardization for public use in the field of telecommunications and the rights of the owners of IPRs.” See “ETSI Intellectual Property Rights Policy” available at http://www.etsi.org/images/files/ipr/etsi-iprpolicy.pdf.

[11] For example, see https://www.twobirds.com/en/insights/2019/global/dissecting-tcl-v-ericsson-what-went-wrong for a comparison on of ‘unpacking’ in TCL v Ericsson and Unwired Planet v Huawei, both of which related to Ericsson patents and determined different rates.

[12] For example, see See Innovatio IP Ventures, LLC Patent Litig., No. 11 C 9308, 2013 WL 5593609, (N.D. Ill. 3 October 2013. Available at: https://casetext.com/case/in-re-innovatio-ip-ventures-5. “In light of the absence of any comparable licenses, the court will consider other methods that the parties proposed for determining the RAND rate that the parties would have agreed to in the hypothetical negotiation.”

[13] For an overview of cases using comparables see Igor Nikolic, Licensing Standard Essential Patents: FRAND and the Internet of Things (2021, Hart Publishing), pp. 103-110.

[14] See Robert O'Donoghue KC, Jorge Padilla, The Law and Economics of Article 102 TFEU (2020, third edition, Hart Publishing), Chapter 13. “Any use of a comparables approach must be alive to the risk that the compared licences themselves include an improper element reflecting an abuse of a dominant position by one or more of the parties to those licences. In such circumstances, there is a risk of circularity or perpetuating non-FRAND terms by relying on licences that themselves involved non-FRAND rates.”

[15] In practice, SDOs, such as 3GPP, specify standards on the basis of technical merit. Prices are not considered in the standard development process.

[16] The ex-ante benchmark was developed in DG Swanson and WJ Baumol, “Reasonable And Non-Discriminatory (RAND) Royalties, Standards Selection, And Control Of Market Power,” Antitrust Law Journal, Volume 73(2), pp. 1-5. Also see: A Layne-Farrar, J Padilla, R Schmalensee, “Pricing Patents For Licensing In Standard-Setting Organisations: Making Sense Of FRAND Commitments,” Antitrust Law Journal, Volume 74(3), pp. 671-706; and M Lemley and C Shapiro “Patent holdup and royalty stacking”, Texas Law Review, Volume 85, pp. 1941-1996

[17] Technically, the minimum incentive would also reflect the ex-ante expectation of success, as investments may fail, or the technology may lose to competitors once successfully developed.

[18] For instance, this may be reflected in the case where prominent wireless technology developers declined to license their patents under the terms of the IEEE’s updated 2015 patent policy.

[19] See J. Gregory Sidak, “The Meaning of FRAND”, Journal of Competition Law & Economics, 9(4), 931–1055; Epstein, Richard A. and Kieff, F. Scott and Spulber, Daniel F., The FTC, IP, and SSOs: Government Hold-Up Replacing Private Coordination (August 5, 2011). Journal of Competition Law & Economics, March 2012, Stanford Law and Economics Olin Working Paper No. 414, GWU Legal Studies Research Paper No. 578, GWU Law School Public Law Research Paper No. 578, NYU Law and Economics Research Paper No. 11-26, U of Chicago Law & Economics, Olin Working Paper No. 568, Northwestern Law & Econ Research Paper No. 11-23, Available at SSRN: https://ssrn.com/abstract=1907450 or http://dx.doi.org/10.2139/ssrn.1907450; and

[20] For instance, Melamed, Doug and Shapiro, Carl, How Antitrust Law Can Make FRAND Commitments More Effective (January 2018). Yale Law Journal (Available at https://faculty.haas.berkeley.edu/shapiro/frandcommitment.pdf) argue that “typically, a new technology is licensed only after it has been developed, whether or not it has been included in an industry standard. By the time the owner of the new technology negotiates licenses with users, the owner has already incurred various R&D expenses. This is common in the development of products of all types. In effect, technology developers make speculative investments. Technology developers typically bear a risk that, having made a speculative investment, their technology will not be sufficiently compensated by an arms’ length market bargain to provide an attractive return on investment.”

[21] Letter from Bruce Sewell, General Counsel, Apple, Inc., to Senators Leahy and Grassley, July 18, 2012.