Emergency interventions to cap market revenues: The need for an exit strategy

Share

Economists Fabien Roques, Charles Veraeghe and Augustin Lorne co-authored a paper for Euractiv discussing the emergency interventions to cap market revenues. The authors analyse the economic impact and the distortions to the integrated European electricity markets induced by the caps on market revenues for inframarginal technologies that have been implemented across Europe as emergency measures.

Introduction

The caps on market revenues for the generation of electricity from inframarginal technologies introduced during the energy crisis as emergency measures have been implemented in different ways across members states which creates distortions and could delay investments necessary for the energy transition.

These temporary measures should be phased out and replaced by other mechanisms currently being discussed as part of the forthcoming structural market reform to provide a predictable framework for investment and enhance customer opportunities to hedge such as power purchase agreements (PPAs) and two ways Contracts for Difference (CfDs).

Emergency interventions have led to a patchwork of approaches for implementing caps on wholesale power market revenues across Europe.

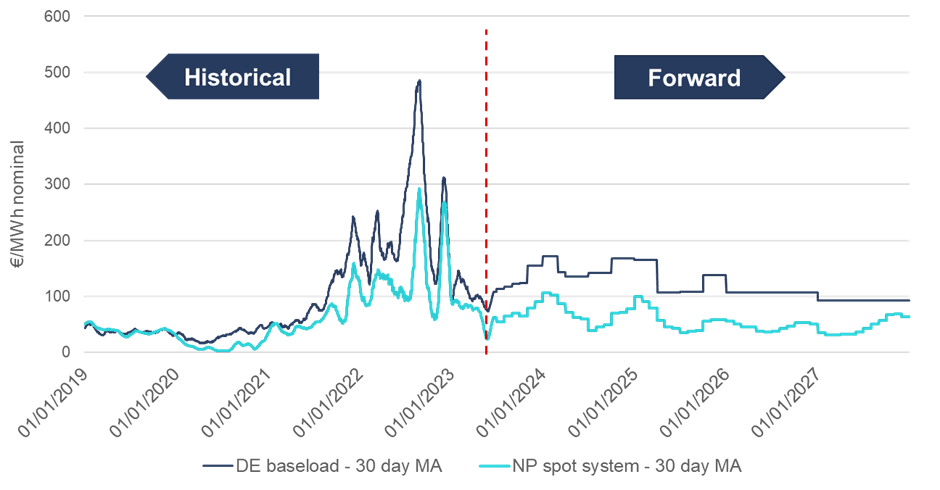

Wholesale power prices were propelled to uncharted territories in 2022 mainly by the gas supply shortages (see Figure 1), which triggered wide ranging interventions in retail and wholesale markets to protect consumers across Europe.

Figure 1 – Daily power price (EUR/MWh). Source: Compass Lexecon based on Energy Market Price. Note: Prices are 30-days moving averages, as of June 20, 2023.

On wholesale power markets, policy makers introduced different mechanisms to limit revenues of generators whose operating costs did not increase due to rising gas prices (such as renewables, nuclear, and lignite) and therefore could make higher profits. Such measures were referred to by the European Commission as “caps on market revenues for the generation of electricity from inframarginal technologies”.

The Council emergency regulation of October 6, 2022 provided a framework for the implementation of such mechanisms across Member States, but left significant degrees of freedom to each government. Ultimately, this has led to a patchwork of uncoordinated approaches across Europe:

Technologies covered: while wind and solar technologies are covered by all countries having implemented caps on market revenues for inframarginal technologies, other inframarginal technologies (such as nuclear, hydropower, or biomass) are considered in some countries, while excluded in others (Figure 2).

Figure 2 – Technologies covered by the cap on market revenues for the generation of electricity from inframarginal technologies by country (April 2023). Source: Compass Lexecon based on Eurelectric and research. Note: Some exclusions to the cap on market revenues for the generation of electricity from inframarginal technologies apply in some countries for renewable capacities under fixed price contracts (PPAs/ forward) – and under support schemes capping revenues.

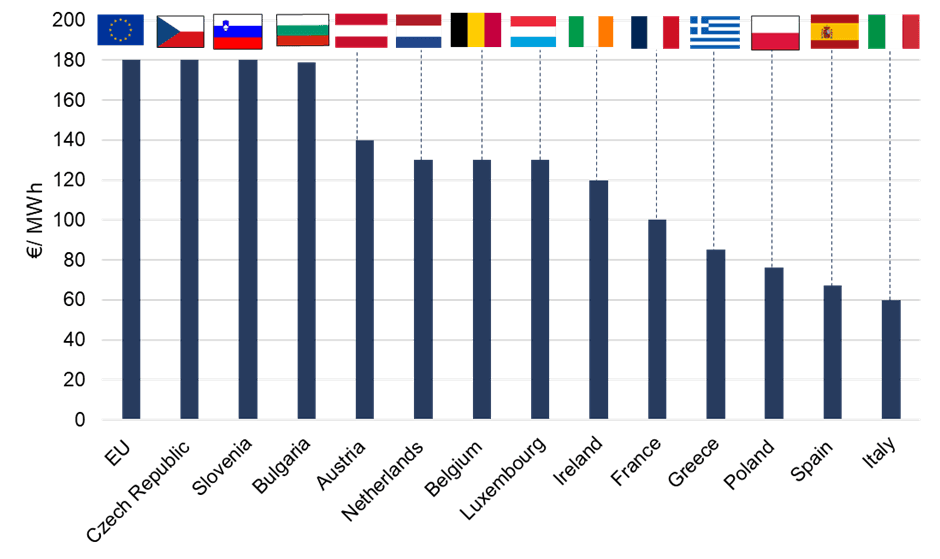

The level of the cap also differs across countries and technologies (see Figure 3). For instance, the cap on market revenues for inframarginal technologies applying to onshore wind generation is around 76 €/MWh (345 PLN/MWh) in Poland, while it is set at 180 €/MWh Czech Republic and Slovenia. In addition, there are exemptions from the cap for renewable capacities under fixed price contracts such as PPAs/ forward contracts or support schemes (e.g. in Spain, Poland, Italy).

Figure 3 – Level of the cap on market revenues for onshore wind in selected EU countries. Source: Compass Lexecon, based on European Council, Bruegel, Reuters, Balkan Energy News, Eurelectric, EU Parliament, Tax Foundation, Governments of France, Belgium, Ireland, Netherlands & Spain, Bulgarian Photovoltaic Association. Note: In Austria, if investments in the energy transition can be proven, the level of the cap increases to up to €180.

Caps on market revenues risk undermining investment and the efficiency of the single internal market

The critical role of inframarginal revenues to provide efficient investment signals is often misunderstood.

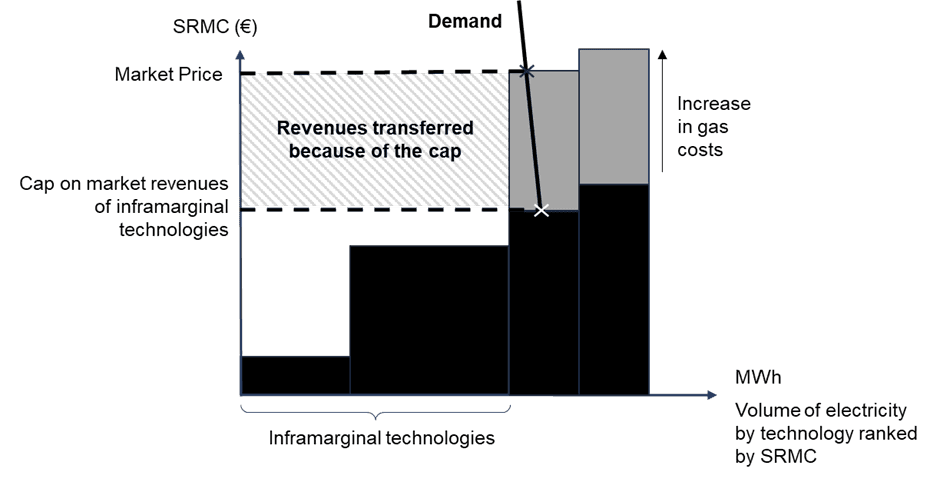

The ‘merit order’ principle through which generators are dispatched based on increasing variable costs minimises the short run power system costs (Figure 4).

But this approach also ensures an efficient remuneration for all plants – that is the larger inframarginal revenues of generators with lower variable costs is necessary to compensate for their higher investment costs. In other words, these inframarginal revenues are legitimate and are essential for the efficient functioning of power markets in the long term, for instance to provide signals for entry and exist of power generators.

This fundamental principle is often misunderstood when considering interventions that claw back some of the inframarginal revenues for generation technologies with low variable costs (see e.g. Boiteux (1956), Schweppe, Caramanis et al. (1990) establishing the principles of the peak load pricing theory that underpins electricity markets).

There is a well-established academic and expert evidence that capping these revenues for some technologies will distort investment incentives (see e.g. Hogan (2005), Joskow (2006), Roques (2009)).

Figure 4 – Illustration of the cap on market revenues for the generation of electricity from inframarginal technologies mechanism. Source: Compass Lexecon. Note: SRMC refers to the Short Run Marginal Cost.

More specifically, the caps on market revenues introduced as temporary emergency intervention in different European countries reduce incentives to invest in new capacity.

They affect mostly low-carbon inframarginal technologies, but also due to the way the caps have been implemented they may also affect flexible and peaking capacity. In addition, applying different caps for different technologies could distort the generation mix compared to the most efficient combination of technologies.

Setting the caps at different levels in different countries as part of the integrated EU market would also affect the choice of location for new plants. This is pointed out by Joskow for example, stating that “price caps that constrain prices to levels below competitive market prices in some periods […] would induce the wrong mix of generating capacity“. Overall, these measures could increase the total costs of the European electricity system.

The discussions on a structural reform of EU power markets should therefore be accompanied by a plan for a coordinated approach to phase out such caps on market revenues to avoid slowing down the necessary investments for the energy transition.

Indeed, as a result of the policy uncertainty associated with the lifting of these caps on market revenues for inframarginal technologies, a number of projects have been put on hold across Europe and extension of these caps could lead to a standstill of investments which would jeopardize Europe’s decarbonisation targets. As an example, according to WindEurope, in 2022 Europe invested only €17 billion in new wind projects compared to €41 billion in 2021, the lowest since 2009.

Ongoing discussions to implement a cap on market revenues as a permanent feature triggered in case of crisis raises complex implementation questions

Recent EU debates regarding the electricity market reform have focussed on the approach and conditions for embedding a cap on market revenues for inframarginal technologies as a permanent feature of the wholesale market design, to be triggered at times of “regional or Union-wide electricity price crisis”.

As explained before, such measure could introduce distortions and slow down investment, particularly for the clean technologies that have low variable cost and substantial investment costs. By pulling the brakes on investment, such cap would be detrimental to achieving the renewables deployment targets based on merchant incentives, and would create an enduring need for support mechanisms to fill the gap of the missing revenues due to the cap.

Moreover, implementing a cap on market revenues at time of crisis would represent a fundamental change in the balance of risk and returns faced by investors. Indeed, such measure would induce an asymmetric risk regime for generators as it would imply that market revenues would be clawed back at times of high prices induced by a ‘crisis’ for inframarginal plants, but plant operators would not get symmetrically compensated at times of low prices (while such issue could be addressed e.g. by well-designed two-way CfD).

If applied to existing generators such measure could lead to a loss of expected revenues compared to the expectations that generators could have when they invested and could be challenged legally if generators would not be compensated for this loss of expected revenues.

Finally, the implementation of such measure would also raise a number of implementation questions which question its practical feasibility and efficiency:

Generators have different costs, even for plants with similar technologies. A uniform revenue cap would affect plant profitability differently depending on their costs. Differentiating the cap level by technology as some countries do with current emergency measures may not be sufficient to account for differences in costs.Despite all these issues, in case policy makers would decide that a cap on revenues for inframarginal technologies should be implemented as a permanent feature of the market to be activated at times of crisis, the definition of the conditions under which the measure could be activated is very important to limit these potential damaging effects.

The key issue for investors is to have a predictable framework setting out the conditions under which such price cap could be activated, and the extent to which it would reduce expected revenues at times of peak prices.

To limit the distortions associated with such a cap on market revenues that were detailed previously, the activation of such revenue cap should be limited to extreme crisis situations, and adequate mechanisms should compensate for the loss of expected revenues. The criteria to trigger their introduction should be clear and transparent to avoid regulatory and policy uncertainty and provide a predictable framework for investors.

Redistribution issues are best dealt with outside of the market through other mechanisms that do not distort market functioning

More fundamentally, we think that the EU debate on caps on market revenues for inframarginal technologies mixes two different policy objectives, which should be addressed through different types of mechanisms:

redistribution policies aiming to claw back revenues from inframarginal generators to the benefit of consumers when prices are high.

The first is largely a technical issue to ensure that the market can clear at times of crisis, whilst the second issue can be dealt with more efficiently with other mechanisms than with a revenue cap triggered at time of crisis.

Introducing mechanisms to redistribute profits from inframarginal generators to some consumers is a national policy choice that should not affect the internal European energy market efficiency. A range of contracting mechanisms discussed as part of the ongoing market reforms could be used to achieve this policy objective and provide the required predictability for investment without distorting markets.

For instance, two-way contracts-for-difference awarded through auctions can be an effective tool to prevent the need for setting price caps at times of high prices – while at the same time protecting investors against risks of low-price periods. Corporate taxation options are another way to achieve the desired policy redistributive outcomes while preserving the integrity of the internal energy market functioning.

In conclusion

Looking ahead, existing caps on market revenues for inframarginal technologies introduced as temporary measures during the crisis should be phased out and the structural reform on market design should focus on other mechanisms such as CfDs to achieve the desired policy objectives of supporting investment whilst protecting consumers.

Should a cap on market revenues for inframarginal technologies be embedded as a permanent feature in the market design following the European Commission, Council and Parliament discussions despite its negative impacts and complexity of implementation, a common EU approach should be defined and restrict its application to extreme circumstances.

This paper was originally published for Euractiv here. The views expressed are those of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees, or clients.