Digital Markets: Competition Tools in Practice

Share

In March 2021, Compass Lexecon held its 15th annual UK Competition Policy Forum which brought together a distinguished group of senior competition law practitioners, economists, academics and regulators to discuss topical matters at the intersection of competition law and economics.

Our first panel reviewed competition tools in digital markets, specifically the effectiveness of competition policy in addressing concerns about abuse in “Big Tech” platform markets. Following the keynote speech on the topic of competition policy in the digital economy, delivered by Tim Wu – Julius Silver Professor of Law, Science and Technology at Columbia Law School, a roundtable discussion followed a panel composed of; Sally Hubbard, Director of Enforcement Strategy at the Open Markets Institute; Yih-Choung Teh, Group Director of Strategy and Research at Ofcom; Mike Walker, Chief Economic Advisor at the UK Competition and Markets Authority and Paul Reynolds from Compass Lexecon. The panel was chaired by Kadu Prasad from Compass Lexecon. The discussions are summarized here by Alyssa Lam.(1)

Competition concerns in digital markets

Digital markets are widely seen as functionally and structurally distinct to other industries, with a natural tendency towards concentration and market “tipping”. While antitrust investigations into digital markets have taken place since the 1990s, more recently competition authorities and practitioners alike have been questioning whether existing competition policy is the right tool, or whether new ex-ante regulation is required.

Some concerns relate simply to the size and reach of these businesses, others are more specifically related to the economics of digital markets. For instance, as consumers are spending more of their time and money online, digital platforms are gaining access to increasingly large volumes of data. Depending on the type of data gathered and the relevant market context, this data may provide a competitive advantage to the platform by allowing it to uniquely leverage the information and drive more value to users. Attracting more users in turn results in more data, further entrenching an advantaged position. There are also concerns that traditional competition law enforcement is simply too slow to react to developments in these fast-moving industries.

So far, it seems that competition authorities and wider government have been moving towards greater ex-ante intervention, including in the US, UK, and EU. However, there is little consensus on the degree and manner of intervention. For instance, how should authorities trade-off between static and dynamic efficiency? What is the potential impact of intervention on incentives to innovate? How should governments weigh different consumer outcomes, such as the benefits of competition and data privacy?

Has existing competition policy been effective?

Discussants generally questioned the efficacy of existing competition policy and remedies to address concerns about abuse in digital markets.

Though “Big Tech” has undoubtedly produced products and services which consumers find to be valuable, discussants observed it has also resulted in durable monopolies that have in some cases lasted decades and are unlikely to self-correct in the short-term.

For example, the CMA’s recent market study into online platforms and digital advertising revealed that Google has more than a 90% share of the search advertising market in the UK, while Facebook has over 50% of the display advertising market. The CMA found that both have been highly profitable for many years, leveraging their market power to build large ecosystems of complementary products and services. This in turn can give rise to conflicts of interest. For instance, Facebook cut off Vine’s access to its ‘Find Contacts’ feature once it was acquired by competing social media platform, Twitter, in 2013.(2)

The current role of antitrust is targeted at specific conduct where there is evidence of harm. Concerns in digital markets often relate to conduct like foreclosure through leveraging a dominant position, for which antitrust has established analytical frameworks. However, attempts to discipline and curtail market power of digital platforms have so far arguably not been effective. Cases like the European Commission’s investigation into Google Shopping demonstrate the limits of current antitrust policy, which result in one-off interventions that take effect too late to be effective.

A key difficulty for antitrust in digital markets is that there are often many potential issues that cannot be dealt with in a single case. Targeting specific conducts individually is resource-taxing and may not curb digital platforms’ overall incentives to misbehave. Moreover, effective remedies are difficult to design. They do not necessarily restore competition and may deter or distort conduct in the meantime.

For instance, the European Commission’s investigation into Microsoft engaging in anti-competitive tying of Windows Media Player with its PC operating system resulted in a decision ordering Microsoft to provide a version of Windows which did not include Windows Media Player, but for the same price. While this might seem like a logical remedy motivated by enabling consumer choice, it ultimately failed to preserve competition between media players, as consumers continued to only purchase the version of Windows with Windows Media Player. User-driven remedies like requiring platforms to allow users to port data easily may ultimately fail for these reasons. They do not account for information costs, or that consumers have limited time and technical abilities.

There has been much consideration of whether structural break-ups of digital platforms are an appropriate remedy. These are appealing as they are self-executing and would not require governments to monitor or continuously intervene. However, the risk is that break-ups are costly and may erode efficiencies. There is also no guarantee that the separate entities would not continue to cooperate in future. “Big tech” firms in particular tend to operate conglomerates and ecosystems that span multiple markets, making it extremely difficult to measure the costs and benefits of different remedies. On the other hand, the mere threat of separation may have important disciplinary effects.

What should future regulation look like?

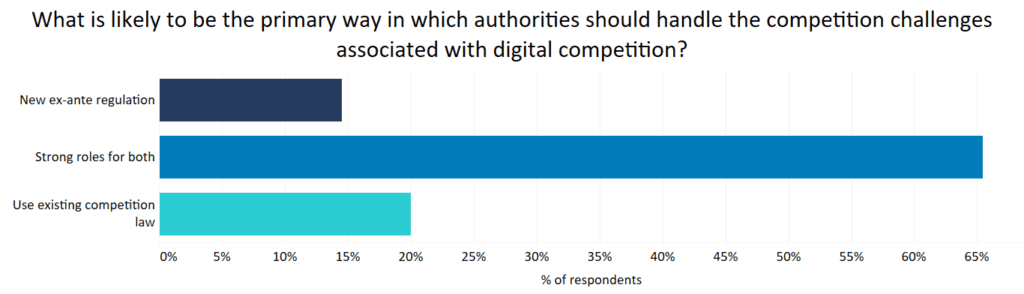

When asked how authorities should handle competition in digital markets going forward, participants’ views ranged along a spectrum, with some pushing for new ex-ante regulation, others suggesting existing competition law is sufficient, but the majority seeing strong roles for both (as shown in the graph below).

Some argued for stronger antitrust enforcement, backed up by structural remedies like break-ups or regulation requiring structural separation. Similar to the way financial exchanges are prevented from trading as buy-side or sell-side on their own platforms, technology companies should not be both “player” and “referee” on their own platforms. Algorithms, or the “rules of the game”, should instead be made transparent.

Others supported the development of more sector-specific ex-ante regulation. The EC has proposed the Digital Markets Act and Digital Services Act, while in the UK there are proposals to set up a Digital Markets Unit to enforce a code of conduct on platforms with “strategic market status” (gatekeeper platforms with substantial entrenched market power). Recognising that there are key differences between digital platforms, including the extent to which they benefit from network effects and their use of data, each platform would have its own tailored code of conduct, to be updated as the market evolves.

Ex-ante regulation is attractive because it avoids the two key shortcomings of current antitrust policy: delay and the lack of a regulatory body for ongoing oversight and the adjustment of remedies. Proponents were of the view that ex-ante regulation should encourage competitive markets and support dynamic efficiency, rather than damage innovation incentives. However, it carries with it the danger of intervening too quickly, without sufficient evidence of harm. Moreover, the generalization that greater competition improves innovation incentives is far from established.

In the UK, the CMA is proposing that digital platforms with strategic market status would also need to report all merger and acquisition transactions, with certain transactions requiring clearance beforehand. Clearance would be based on showing no “realistic prospect” of a substantial lessening of competition. However, it is far from clear that acquisitions by digital platforms warrant a lower standard of proof. Acquisitions are often an important way for complementary technologies to be combined, or for innovations to be further developed and commercialized. The potential for such acquisitions is likely to stimulate additional R&D investment, and so, conceptually, a balance of harms approach may be more appropriate.

Conclusion

Overall, there was some recognition among discussants that “Big Tech” platforms have driven significant gains and value for consumers, but that the nature of these markets could mean that potential harms and market failures may also be amplified. Participants were split on how to deal with these concerns, with some seeing a role for broad-brush structural separation, others supporting more targeted ex-ante regulation to complement existing competition policy and a few skeptical of whether these developments require any fundamental change to antitrust. Nevertheless, a common theme was that competition policy must be fast and fair and preserve the innovative nature of digital markets.

Many questions remain unanswered, and these will no doubt keep competition practitioners on our toes seeking answers for many years to come.

- All panelists were speaking in a personal capacity, not representing the views of any institutions. This summary follows the Chatham House Rule and therefore does not attribute views to any individual panelist or other participants.

- CMA, 1 July 2020, Online platforms and digital advertising – Market study final report, para. 3.231.