The Substantive Test in Merger Control

Share

In March 2021, Compass Lexecon held its 15th annual UK Competition Policy Forum (entirely online for the first time), which gathered a distinguished group of senior competition law practitioners, economists, academics and regulators to discuss topical matters at the intersection of competition law and economics.

Our panel discussion concerned the substantive test in UK merger control, in particular the revised merger assessment guidelines (MAGs) of the UK’s Competition and Markets Authority (CMA), and the CAT’s judgment in JD Sports v CMA. A roundtable discussion followed presentations by Andrea Gomes da Silva, Executive Director of Markets and Mergers at the UK CMA; Brian Kennelly QC, Barrister at Blackstone Chambers; and Nelson Jung, Partner at Clifford Chance LLP; in a panel chaired by Neil Dryden from Compass Lexecon. The discussions are summarized here by Cecilia Nardini. (1)

Review of the MAGs

The CMA initiated a review of its MAGs in November 2020 and is currently considering the responses to its consultation (closed in January 2021). Although there is no proposal to change the CMA’s statutory test, the review is intended to reflect the developments in merger control since the last MAGs were adopted ten years ago and the evolution of the CMA’s approach over that period. The CMA’s consultation document(2) outlines the broad objectives of this process, which are: (i) to reflect the evolution in the economy and the way goods and services are delivered, particularly in relation to (but not limited to) digital markets; (ii) to learn from the review of the CMA’s past cases, through its own introspection as well as the applicable judicial review; and (iii) to learn from the experience of other competition authorities around the world, and expert reports and academic literature produced in recent years, including ex-post assessments of the CMA’s decisions.(3)

The Panel discussed the review of the MAGs against the backdrop of statistics on CMA intervention rates in recent years, with participants debating whether the apparent increase in deal mortality rates is due to a larger number of deals that “should not leave the boardroom”, widespread underenforcement in the past or the CMA’s approach becoming tougher despite the legislation remaining the same.

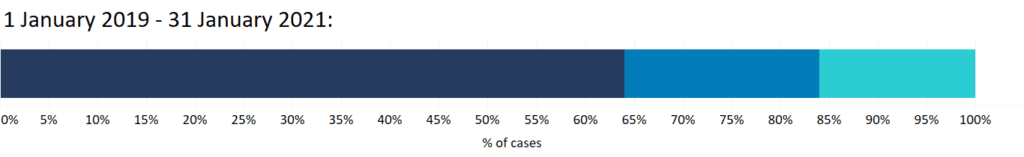

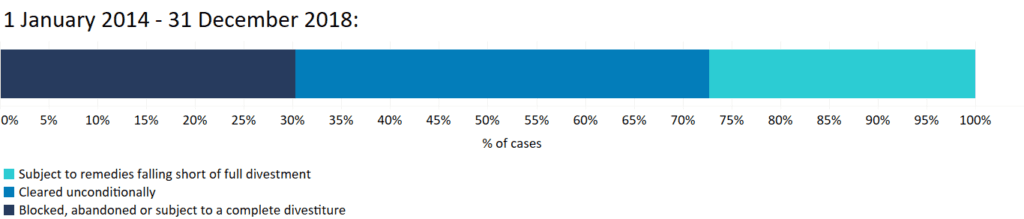

Figure 1 shows the Phase 2 merger decisions from 2014 to January 2021.

Figure 1: Phase 2 merger decisions

The main areas of change proposed in the revised MAGs

Participants debated three of the areas of change proposed in the revised MAGs.

The first concerns potential competition and innovation, themes which have been particularly relevant in recent CMA cases in digital markets (e.g. Paypal/iZettle and Sabre/Farelogix). In the revised MAGs, the CMA aims to place greater emphasis on dynamic competition and to clarify its assessment of the loss of future potential competition between merging firms, which will depend on whether (i) the merger involves a potential entrant, and (ii) existing and potential competitors interact in an ongoing dynamic competitive process (e.g. via investments in innovation) that may be lost with the merger.(4)

The discussion focused on the evidence that the CMA might use to make this assessment and the definition of dynamic counterfactuals. Participants felt that, where one merging party says they would not have entered organically, it would not be appropriate for the CMA to decide itself that entry was a realistic possibility – or to conclude, in an extreme example, that Firm A was likely to enter a market purely by virtue of the fact that it was planning to buy Firm B, who is present in that market. Instead, participants argued that the assessment should be based on evidence from internal documents and the type of competition between the merging parties (e.g. if they compete mainly on innovation). The final determination will also have to reflect the appropriate legal test – e.g. in Phase 2, the CMA would have to demonstrate that entry is the most likely scenario (as turned out to be the case in Sabre/Farelogix) to raise concerns on potential competition grounds.

The second area concerns the uncertainty in merger assessment. It is implicit that the CMA will need to take decisions under uncertainty, but participants noted that there had been some confusion about how the CMA assesses and weighs the evidence when there is a significant degree of uncertainty (particularly in the context of emerging and fast-moving products) and whether the statutory test needs to be adapted to those circumstances. The revised MAGs clarify how the CMA interprets the evidence and explain that uncertainty does not affect the legal test, i.e. the presence of some uncertainty will not preclude the CMA from finding an SLC if that is what the rest of the evidence suggests to the appropriate legal standard.(5) As discussed below, the recent CAT judgment in JD Sports vs CMA also suggests that the CMA is not required to adopt a probabilistic approach with regard to each element of a theory of harm, but will consider the whole evidence in the round.

The third area of change concerns market definition, which remains a polarising topic. Many agreed that market definition is not a black-and-white concept, and the revised MAGs aim to move away from a mechanistic and often duplicative approach between market definition and competitive assessment (particularly important with differentiated products, for which it makes sense to identify stronger and weaker constraints on the merging parties rather than defining the exact boundaries of the market)(6). In this framework, for example, shares of supply would be relevant where boundaries are clear and would have some, but lesser, weight when the boundaries are not clear; and pricing pressure indices would remain a useful scoring mechanism to rank the degree to which a large number of local overlaps create competition problems.

Some participants felt that this approach may increase uncertainty and introduce some confusion with other aspects of the revised MAGs, e.g. that when there are fewer significant players, the CMA will have a presumption that any two will be close competitors. Without a proper market definition exercise being undertaken, it would be difficult to know which players to count for this assessment.

More generally, there was a debate as to whether the analytical framework set out in the revised MAGs is more or less balanced than in the current MAGs, with some participants welcoming certain aspects such as the removal of limb number three of the exiting firm scenario (i.e. the assessment of what would have happened to the sales of the firm in the event of exit, and the impact of this on competition)(7), and others pointing out the risk of too much discretion on the part of the CMA with regard to the interpretation of the evidence provided, creating additional uncertainty, signals of a tougher approach on efficiencies and countervailing factors, and potentially a structural presumption of competitor harm. It was noted that, in a broader context where the UK needs to continue attracting investment, the CMA should refrain from becoming unduly interventionist or effectively abandoning tools that used to provide a degree of certainty.

CAT’s judgment in JD Sports v CMA

The second development discussed in the panel was the CAT’s judgement in JD Sports v CMA, in particular on Ground 1 on the substantive legal test and the evidence that the CMA is required to provide to find a substantial lessening of competition (SLC)(8). The CMA had found that the parties were close competitors and listed a non-exhaustive number of parameters on which they compete (without specifying how much they compete on each parameter) and used a GUPPI analysis to determine pricing incentives post-merger.

The question brought to the CAT was whether this was enough: whether, once the CMA had found high GUPPIs and identified the parameters on which the parties compete, it needed to provide a causal link between the merger and the loss of competition to find an SLC, or whether it could have reached a view based on the whole evidence, without adopting a probabilistic approach with regard to each element of a theory of harm.

The appellant’s view was that competition does not take place in a vacuum but on specific parameters, so a lessening of competition needs to be expected in at least one parameter of competition, to find an SLC. The CAT rejected this aspect of the appeal, stating that once the parties are found to be close competitors on a number of parameters, that closeness is sufficient to conclude that the merger would remove a significant competitive force on the market, which is in itself capable of leading to an SLC.

Discussants were ambivalent about this aspect of the judgment. They felt that, even though the CAT was particularly critical of the CMA (and even said that some of the evidence gathering was “irrational”), it seemed keen not to constrain the CMA, but rather give it the broadest possible toolkit.

Participants discussed whether this leaves the CMA too much discretion since in any merger there are parameters on which the parties compete, but it was argued that the removal of competition on certain parameters would not necessarily lead to an SLC. On the other hand, if there is an SLC it should be relatively easy to demonstrate causation on at least one of the parameters of competition. Some queried whether the judgment raises broader concerns about the standard of proof that the CMA is required to abide by, and whether the CMA may now have more leeway to reach a decision based on whatever evidence is available, even if more could be done to gather additional evidence.

Some thought an experienced tribunal should demand more of a specialist regulator, and suggested the CAT should be more critical of the CMA and perhaps test the evidence itself. However, the principles of English law currently underpinning the CAT’s approach (rationality standard) are flexible, so others felt no radical change is needed in this area. All is needed is for the CMA to operate to a standard, within the existing framework, that would survive challenge in a court of appeal.

- All panelists were speaking in a personal capacity, not representing the views of any institutions. This summary follows the Chatham House Rule and therefore does not attribute views to any individual panelist or other participants. Andrea Gomes da Silva left by prior arrangement to avoid being present during any discussion of JD Sports vs CMA, given the CMA’s ongoing work on the merger.

- Draft revised Merger Assessment Guidelines: Consultation (“MAGs consultation document”). Available at https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/935598/Consultation_Document_-.pdf

- MAGs consultation document, paragraph 1.4 et seq.

- MAGs consultation document, paragraph 1.42 et seq.

- MAGs consultation document, paragraph 1.30 et seq.

- MAGs consultation document, paragraph 1.52 et seq.

- MAGs consultation document, paragraph 1.36 et seq.

- Judgment 1354/4/12/20 JD Sports Fashion plc v Competition and Markets Authority, published on 13 November 2020. Available at: https://www.catribunal.org.uk/judgments/135441220-jd-sports-fashion-plc-v-competition-and-markets-authority-judgment-2020-cat-24.